Climbing the Ladder to Escape Inflation

Interest rates are rising, slowly. Federal Reserve policies seem to be pointing to even higher rates. And, after a decade of historic low rates the increases are welcome by income investors. But, the increases raise an important question for many income investors.

Income investors are faced with a dilemma that is easy to understand. They wonder if they should invest now, potentially locking in rates that are higher than they were a few years ago or wait for higher rates which seem possible within months.

There is a solution to this problem that involves investing now and later. It is a solution that could meet the needs of many investors and it is known as a bond ladder.

A Ladder Reduces Risk

Fixed income investing means buying an investment and collecting income until maturity at which time the amount of investment is returned. This requires making a decision about how long to invest the money for. Longer periods to maturity offer higher income.

But, longer terms also carry the risk that interest rates will rise. If rates rise, the investor loses out on potentially higher income. The difference in rates for different periods of time is significant so the decision can be challenging.

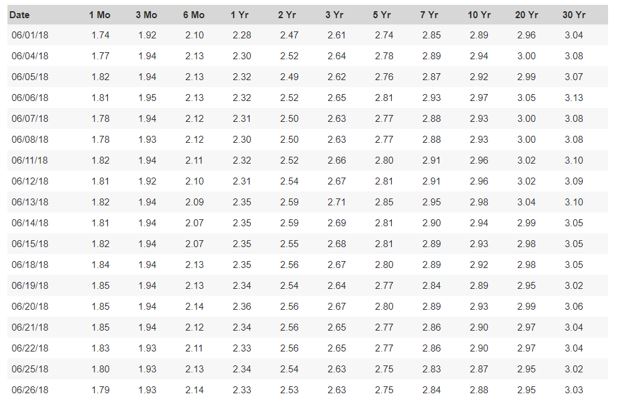

Source: US Treasury

An investor could earn an annualized rate of 1.79% using Treasury bills maturing in one month. Or, they could lock up funds for 30 years and earn 3.03% a year.

The probability of rates rising within the next 30 years appears to be high and the investor would forego higher income if they lock in that rate now. That is because the value of the 30 year bond will fall as interest rates rise so it will be impossible to sell and lock in the higher gains.

Many investors treat the decision about the maturity of their investments as an all or none type of questions. They decide how long to invest for and then buy a security that matches that time frame. A better alternative could be to use a ladder.

A bond ladder is a multi-maturity investment strategy that diversifies bond holdings within a portfolio. It reduces the reinvestment risk associated with rolling over maturing bonds into similar fixed-income products all at once.

In simpler terms, according to Investopedia, “a bond ladder is the name given to a portfolio of bonds with different maturities. Suppose you had $50,000 to invest in bonds. By using the bond ladder approach, you could buy five different bonds each with a face value of $10,000 or even 10 different bonds each a with face value of $5,000.

Each bond, however, would have a different maturity. One bond might mature in one year, another in three years and the remaining bonds might mature in five-plus years – each bond would represent a different rung on the ladder.”

The Ladder in Practice

Bond ladders do reduce the opportunity costs associated with higher interest rates and they do solve the problem of an all or none decision. However, there is the question of whether or not the bond ladder hurts the income investor if rates fall.

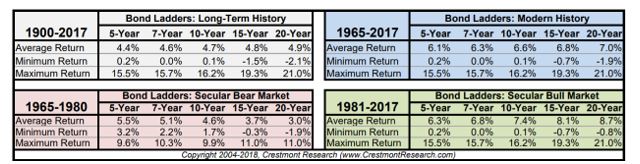

To answer that question, there is data available. Crestmont Research has looked at that question and a summary of their testing is shown below.

Source: Crestmont Research

In a bear market, bond prices are falling, and interest rates are rising. At these times, the left side of the bottom section of the chart, the bond ladder will deliver acceptable returns, on average. Shorter term bonds carry the least risk.

The favorability of shorter term maturities holds in bull markets as well. These are times when bond prices are rising and interest rates are falling. Notice that there is a greater likelihood of losses when 15 or 20 year bonds are used.

The data suggests that 5 years could be the sweet spot for a ladder, especially when facing a secular bear market in bonds as we seem to be now.

To build a five year ladder, an investor could own five bonds, each maturing one year after the next. To build the initial ladder, an investor could buy bonds maturing in 1, 2, 3, 4 and 5 years. As each one matures, a new 5 year bond would be bought.

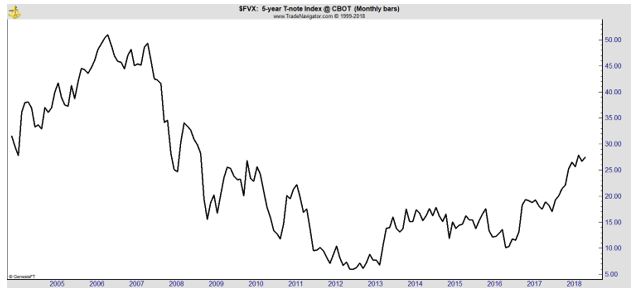

The long term chart of five year Treasury yields does show there is potential up side possible.

Rates could almost double to reach the level they saw twenty years ago. Of course, rates could also fall and they were significantly lower just five years ago.

Alternatively, shorter term investments could be used, maturing every six months, for example. This would require purchasing 10 different securities for a five year ladder but a new five year investment would still be bought when each one matures.

There may not be securities available to exactly match the desired maturity dates and that could require holding cash for some period of time to align the ladder with the objectives. This strategy could take months to properly construct.

Now, income could be increased by extending the maturity of the ladder. However, there are more risks, whether rates rise or fall, with longer maturities. There is no guarantee of profits with this strategy but history shows the five year has never delivered a loss.

There is, unfortunately, no right answer as to what a fixed income investor should do. That is the same situation investors in the stock market face. There are countless possible answers, each with unique risks and potential rewards.

Bond ladders can minimize the pain that fixed income investors experience when interest rates rise. The ladder is designed to adapt to changes in rates and could deliver higher incomes than a buy and hold investment in the long run.

If rates fall, an event that seems unlikely but is certainly possible, a ladder will deliver lower income than a buy and hold investment. Each investor should consider the risks and rewards of the strategies and make the choice that matches their personal preferences for risk.

To read more market related tips, click right here.https://www.investingsecrets.com/blog/